How is Apple’s iOS 14.5 impacting ASO

App Store Optimization (ASO)

October 13, 2022

Apple shook the iOS world when they released iOS 14.5 on April 26th, 2021. Their App Tracking Transparency framework was announced during WWDC 2020 and hung above developers’ heads like an ominous sword of Damocles.

8 months in, what was the real impact of ATT? Was it as bad as expected? How do app marketers navigate a post-ATT iOS world?

The current ATT situation

Apple’s App Tracking Transparency (ATT) framework was designed to prevent access to the IDFA (Identifier for Advertisers) from developers who did not collect an explicit opt-in from users. The IDFA was Apple’s most useful tool for advertising tracking and personalized ads. iOS ad campaigns’ measurements and optimization relied heavily on granting access to consumers’ IDFA.

With privacy becoming a more prominent topic in the tech industry (and anywhere the internet is concerned), users were expected to opt out of tracking en masse. ATT would be a tough blow to personalized advertising.

How many users actually opted-in? Well, that’s a tricky question.

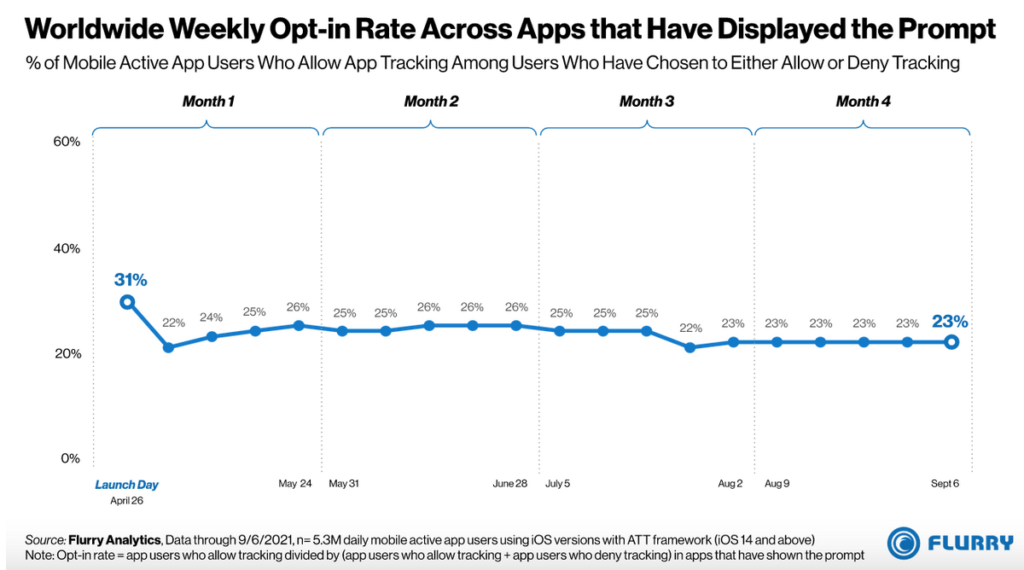

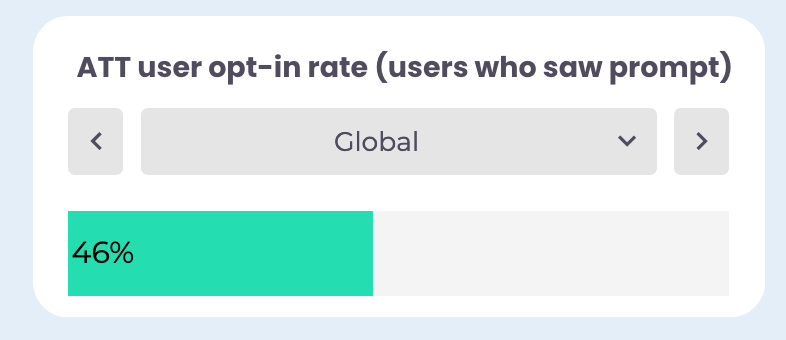

Despite using the same method, AppsFlyers and Flurry don’t actually agree on the numbers. According to AppsFlyers’ latest numbers, 46% of iOS users who saw an ATT prompt opted in. With Flurry, this number falls to 23%. They both have global (and local) data and it’s tough to differentiate their sample size as Flurry uses daily users (5,3M daily users) and 37M total users for AppsFlyers.

If it’s still unclear how many users actually opted-in (or out) of tracking, there’s no denying ATT’s impact. Games developers have been unwilling to publish games after the release of ATT.

ATT vs. social media’s advertising platforms

Ever since ATT’s announcement by Apple, Facebook has been fighting back against it. On the other hand, Snapchat was championing it. Evan Spiegel, Snap’s CEO, even called it “a great change that Apple is instituting. It’s privacy forward and we support it.” This actually backfired for them.

While Facebook had been warning their investors for months that Q3 and Q4 were going to be a little rougher due to ATT, Snap’s stock fell 22% after the publication of its Q3 earnings. They didn’t anticipate such a big disruption and are now getting sued by one of their investors for downplaying ATT’s impact on Snap’s advertising business.

However, Spiegel still stated that ATT is “really important for the long term health of the ecosystem and something we fully support.”. Facebook still stands firmly against it.

The public reaction to Snap’s surprising Q3 earnings made a lot more noise than Facebook’s, mostly because Snap failed to manage expectations while Facebook has been on a warpath about ATT ever since it was announced. They even placed advertisements in newspapers, arguing that Facebook was fighting back against ATT because it was a blow to small independent businesses.

In September, Zuckerberg’s app admitted underreporting iOS conversions by approximately 15%. Because of this, Meta’s stock dropped 4% and many advertisers were seeing a worse ATT impact than what was disclosed by the company. Their Q3 earnings were still $600MM short of expectations.

For Meta, ATT is clearly to blame. Sheryl Sandberg, Meta’s COO, blamed Apple’s iOS 14.5 for decreased advertising accuracy, which then led to higher costs and difficult measuring for advertisers. According to them, e-commerce and gaming took the hardest hit and the impact was greater than expected or as David Wehner, Meta’s CFO stated: “more disruptive than we anticipated”.

On the other hand, Twitter seemed to avoid ATT’s impact with a rise in revenue during their Q3.

ATT is Apple’s Search Ads new best friend

Apple didn’t launch its App Tracking Transparency network solely for privacy purposes. Even though users’ interest in the safety and protection of their data has been steadily rising (and it was in Apple’s interest to do something about it, given their positioning as a safe and privacy-preserving company), Apple had something big to gain with ATT.

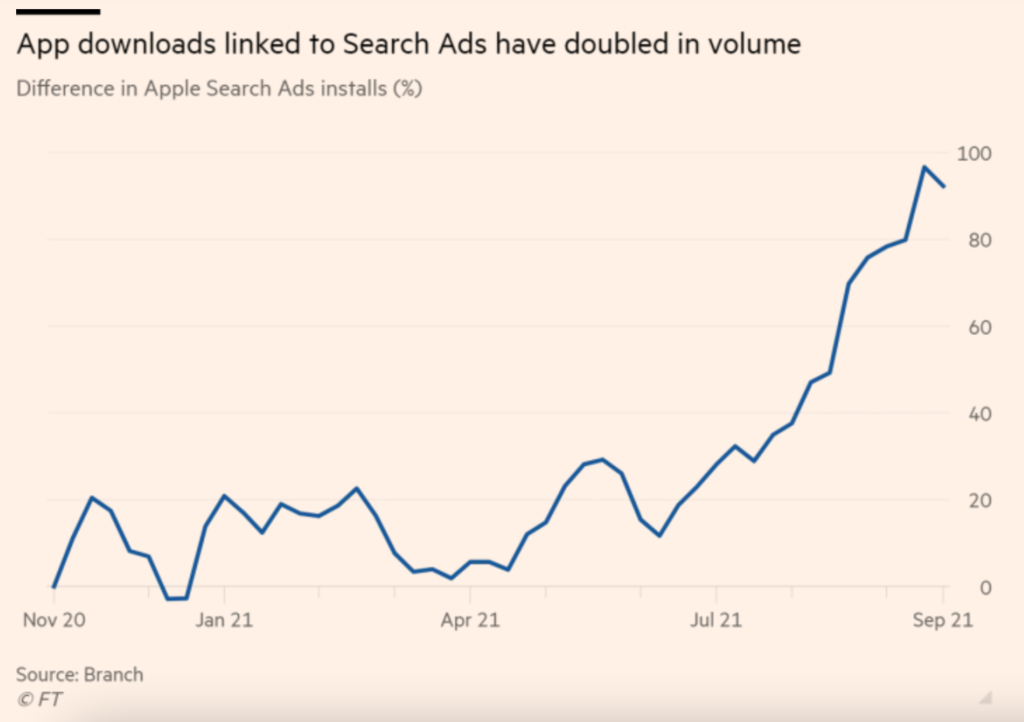

Six months after ATT’s introduction, Apple’s advertising business tripled its market share.

Apple Search Ads offers a special kind of reach in the App Store. Thanks to it you can buy sponsored spots to have your app appear above search results for specific keywords and it’s clearly growing fast. While some big players have seen their advertising businesses impacted by iOS 14.5 (like Snapchat and Facebook), Apple Search Ads’ growth has been unstoppable.

The main advantage of ASA is that it’s not subjected to the limitations of ATT, and doesn’t have to use SKAdNetwork (Apple’s replacement for the IDFA which doesn’t have a lot of fans) for ad attribution. Apple is adamant that its own ad network does not track users although they do use behavioral data.

Because ASA is part of Apple’s ad network, installs driven by it are considered organic, even when an IDFA is not available. Apple can attribute ASA installs whether a user opted in or out of ATT. Giving it a clear advantage over competing advertising products.

Does ATT really prevent tracking?

Former Apple engineers now working for Lockdown Privacy decided to test if opting-out of tracking really prevented user tracking. According to a test they ran on ten top-ranked apps of the App Store, there is “no meaningful difference in third-party tracking activity when choosing App Tracking Transparency’s “Ask App Not To Track”. The number of active third-party trackers was identical regardless of a user’s ATT choice, and the number tracking attempts was only slightly (~13%) lower when the user chose “Ask App Not To Track””.

According to them, because Apple defined tracking as something solely related to advertising, users can actually be subjected to trackers as long as the information is not used to identify consumers for advertising purposes. Meaning that developers can actually track users and use their information as long as it’s not tied to identifying data, by integrating it into cohorts for example.

It’s what a recent report by the financial times showed. Some companies (including Snap and Facebook) kept sharing user-level signals from iPhones users, only making sure that the data was anonymized and aggregated so it wouldn’t be tied to specific user profiles anymore.

What’s in store for ASO?

ATT and the end of IDFA was the topic of the year for app marketers. Even though privacy concerns grew steadily over the past few years, ATT took the mobile world by storm. What happens now? Is it really the end of personalized advertising?

Not exactly. 2022 will sign the big return of contextual advertising and the emergence of cohort marketing. With Apple restricting access to IDFA and Google planning the end of third-party cookies (and a restriction to GAID access for users who decide it), developers have started observing user signals at a group level, targeting cohort behavior instead of individual ones.

Future ads may not be as user-centric as they were lately, but it doesn’t mean you can’t target users efficiently and get your point across to the right people. We’ll see you next week with a post about how to make the most of contextual advertising, which is aiming to be the key to app marketing strategies in 2022.

Did ATT have an impact on your advertising habits? What did you set up to counteract the loss of IDFA? Tell us about it in the comments!

- Mobile Video Monthly #38 – November 2023 - 5 December 2023

- Disturbing ads, a new trend for mobile gaming creatives? - 28 November 2023

- The Power of Holiday Marketing in Boosting Mobile Game Engagement - 21 November 2023